credit: zenobia_joy

In yesterday’s post, guest blogger and CEO of BlitzLocal.com, Dennis Yu, tackled some important concepts of the local ad firm- specifically the fact that it is sure to kick the bucket in 2010 if industry professionals don’t take proactive steps as soon as possible. Part two of this story will address changes the future has in store for local ad agency fiscal models and a closer look at the crucial dynamics of this evolution.

How will the financial model of local adapt over time?

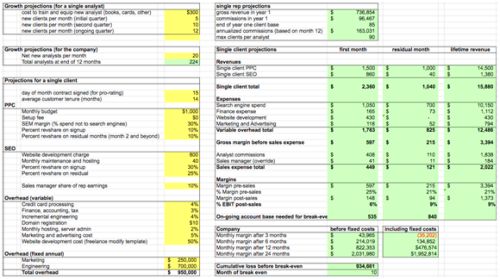

Firms can take a 50% margin until the market gets smart. Consider the current VC-funded, growth-oriented approach of a pretend composite company… we’ll call it SuperLocal, Inc.

Let’s break it down:

- SuperLocal has 250 employees and 5,000 clients that spend $1,000 a month.

- Assume that 150 of these 250 employees are in sales and each agent is able to manage 33 clients.

- That amounts to $400,000 in annual revenue per employee (33 clients that spend $12k per year, ignoring churn).

- If we assume that the firms allocates 50% of the client’s budget to actual spend, that’s $200,000 per gross margin per year per employee.

- However, the firm must also cover sales commissions at 15% ($60,000) and operations at 20% ($80,000), general overhead at 10% ($40,000)- leaving 5% as a profit margin.

Although this is a skinny profit margin, it is partially offset by scale and other efficiencies. Let’s examine each one in detail to see what the most efficient model could look like:

Economies of scale

The cost of operating a PPC platform should decrease as the number of clients you have in the system increases, as you can allocate over a larger user base. We can assume that operations, which consists of software expense (internally engineered or licensed technology), client support, credit card processing charges, and product development is perhaps 60% variable and 40% fixed costs. Thus, economies of scale will lower operations from 20% to a threshold of 12% (60% multiplied by 20%) at high volume.

Sales expense

Eliminating high-pressure sales tactics and having a greater reliance on word of mouth causes several cascading effects. The influx of ex-Yellow Pages salespeople who are making $100k+ a year is helping current firms achieve their acquisition targets, but at high per sale expense and high churn. Assuming an industry average tenure of five months (50% of clients stay for five months) for SuperLocal, Inc., the revenue per client is five months multiplied by $1,000- or $5,000. A 15% commission on that is $750. Should SuperLocal be able to deliver upon the product, it would seem quite feasible to double average lifetime value.

Thus, you could pay the sales agent half the commission rate while keeping their earnings the same. In fact, if you paid the agent based on retention and allowed them to interact beyond the initial sale, you would give them incentive to keep the client longer. Let’s assume that via product improvements, we can safely drop the commission to 10%.

Platform improvements

Even if we hold the percentage of spend constant at 50%, improvements in how campaigns are built, optimized, and automated should be able to squeeze out 50-70% percent improvements at the same budgets. This is based on our experience with clients that have come to us having been unsatisfied with larger market players. The secondary effect of automation and efficiency improvements is that the average employee can handle more clients.

SuperLocal employees should be able to handle triple the number of clients, given that they are not calling to complain as often; we are educating them on our processes, we are transparent in our reporting, and we set up alerts to notify them of performance improvements we’ve achieved. A 3x improvement may seem drastic until you consider what share of current client interaction stems from unhappy client calls.

The positive spiral effect of platform improvements is that the cost per sale decreases due to tenure improvements (clients stay longer), analyst coverage ratios (they can handle more clients), and automation of non-PPC functions not currently offered. Given higher performance, the company can now service clients who, at $500 a month, were previously not serviceable. Further, existing clients will spend more per month when they have greater ROI. Let’s assume that cuts operational expense in our model from 12% to 10% of gross spend.

Greater client satisfaction

One unnoticed side effect is that clients are less likely to go out of business. The current players are putting small businesses out of business, as these firms are unknowingly putting their last dollar on the roulette wheel and hoping for the best. Cigarette companies face the same issue with potentially killing their customers when they overuse the product. But great client satisfaction will not only help clients stay in business in a tough economy… it will encourage word of mouth effects. Consider Amazon.com- they don’t do any advertising—instead, they offer product marketing via free shipping and other consumer incentives.

Local lead gen companies can eliminate sales expense altogether when the leads come in from happy clients. If you conservatively assume that half of SuperLocal’s clients could come through referrals, we cut sales expenses from 10% to 5%. We can also lower operating costs if we create a social gaming system such that anybody is able to set up clients on the platform, thereby creating a local army of resellers.

The resulting new model is local lead gen

Let’s review what these implemented efficiencies do for SuperLocal and how it changes the model:

Holding media spend constant at 50%, we cut sales expense to 5% and operations to 10%. Even holding overhead fixed at 10%- we allow SuperLocal to inflate executive salaries and buy a shiny office tower– the firm’s gross margin still grows to 25%.

Further, since client tenure (how many months they stay on average) has doubled, the revenue per client is $10,000. The existing sales staff of 150 can now handle 15,000 clients, which is a three-fold improvement over the existing 5,000- this is due to operational improvements and no longer losing customers as fast as we gain them.

The company now has annual gross revenues of $180MM with only 250 employees, just about what ReachLocal has with 900 employees and just above MarchEx. We can even assume that as the company has expanded, they’ve been able to reach down to service lower price points, so let’s drop the average monthly spend to $750. And then assume that they increase percent of spend from 50% to 60%-Â effectively sharing back part of the efficiency with their client base.

The gross revenue is reduced to $135MM and net margins fall to $20.25MM… still respectable.

The decrease in price points with automation and efficiency improvements is something our team at Yahoo! predicted 4 years ago- since initially, an improvement in efficiency will decrease spend, as clients are getting the same number of leads for less money. When advertisers are getting ROI, they tend to shift budgets into online channels after 3-5 months. Thus, spend follows a U-shaped curve when we implement efficiency improvements.

Finally, SuperLocal, Inc., has switched their pricing model to cost per call based on a ratecard of geography and category. This has caused them not to gain share from competitors- as there are no dominant players in local yet- but to grow awareness in the market, shed light on unethical business practices, and help force the bad actors out. When that happens, local lead generation will become safe, transparent, and effective- and the overall market will be able to grow healthily.

Transparency in the marketplace is something local online advertising companies should embrace now, rather than wait for the economic realities to force it upon them.

If there were a “Local Bill of Rights,” this one would be ideal:

- Devote 70 cents of every dollar from clients to buying traffic.

- Show clients the same reports you see.

- Don’t have a direct sales force that hands off to an operations call center; your clients should talk to a trained analyst before and after the sale for greater efficiency and better service.

- Drive measurable performance—calls you can see and even listen to recordings of—as well as organic rankings you measure each month.

- Treat client’s money like it’s your money- so everyone in the company is paid based on client retention and feedback from your rating system.

- Grow the company with your own money- not venture capital- so you can grow at the proper pace and focus on the product, not sales growth.

Transparency leads to efficiency, which leads to the accrual of value in the hands of local resellers and maximum percentage ad spend for the client. The pending convergence of local, social, and mobile will create powerful products for local businesses that don’t cost an arm and a leg.

Opinions expressed in the article are those of the guest author and not necessarily AIMCLEAR.